Unlike mining, which requires massive electrical power to validate transactions, staking is an eco-friendly process. Casper is the implementation that will eventually convert Ethereum into a Proof of Stake (PoS) blockchain (also known as Ethereum 2.0). Although Ethereum was launched in the summer of 2015 as a Proof of Work (PoW) blockchain, developers were already planning a long-term transition to the staking model.

After the transition is complete, mining will no longer be part of the Ethereum network. Bitcoin uses a PoW system and as such is susceptible to a potential Tragedy of Commons. The Tragedy of Commons refers to a future point in time when there will be fewer bitcoin miners available due to little to no block reward from mining.

How Does Bitcoin Mining Work?

This allows for blocks to be produced without relying on mining hardware (ASICs). So, instead of competing for the next block with heavy computation work, PoS validators are selected based on the number of coins they are committing to stake. If Casper (the new proof of stake consensus protocol) will be implemented, there will exist a validator pool.

The consensus works to improve the integrity of the system by preventing double-spending. A Ripple user that initiates a transaction with multiple gateways but craftily sends the same $100 to the gateway systems will have all but the first transaction deleted. Individual distributed nodes decide by consensus which transaction was made first by taking a poll to determine the majority vote.

DPoS allows users to commit their balances as votes, which are used to elect a certain number of delegates. Then, the elected delegates manage the blockchain operations on behalf of their voters, ensuring security and consensus. Also, stakeholders are able to stake their coins, receiving periodic rewards for holding funds. Sunny King and Scott Nadal were likely the first to introduce the ideas of Proof of Stake and staking, back in 2012.

However, although the Ethereum Proof of Stake date isn’t yet official, it is hoped that it will increase this number to thousands per second. Mining requires a great deal of computing power to run different cryptographic calculations to unlock the computational challenges. The computing power translates into a high amount of electricity and power needed for the proof of work.

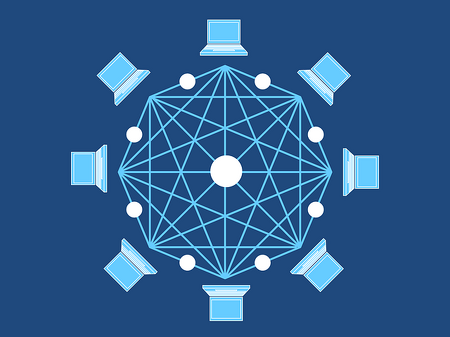

This process will be available through a function of calling the Casper contract and sending Ether – or the coin who powers the Ethereum network – together with it. The proof of stake was created as an alternative to the proof of work (PoW), to tackle inherent issues in the latter. When a transaction is initiated, the transaction data is fitted into a block with a maximum capacity of 1 megabyte, and then duplicated across multiple computers or nodes on the network.

Casper is a technology used to finalize blocks that will facilitate that shift. In other words, the voting power of each validator will be determined by the amount of ETH they put at stake.

The only fees that will be earned will come from transaction fees which will also diminish over time as users opt to pay lower fees for their transactions. With fewer miners than required mining for coins, the network becomes more vulnerable to a 51% attack. The proof of stake (PoS) seeks to address this issue by attributing mining power to the proportion of coins held by a miner. This way, instead of utilizing energy to answer PoW puzzles, a PoS miner is limited to mining a percentage of transactions that is reflective of his or her ownership stake.

At that time, it cost an average of $150,000 a day to maintain the Bitcoin network. Today, this figure is at a staggering $6.7 million (if we assume a $0.12/watt cost and multiply that with the estimated 56,209,833 KWh of electricity that the Bitcoin network consumed on Oct. 13, 2017). The Ripple network does not run with a proof-of-work system like bitcoin or a proof-of-stake system like Nxt. Instead, transactions rely on a consensus protocol in order to validate account balances and transactions on the system.

The so-called ‘Casper Protocol‘ will transform Ethereum from a proof-of-work (PoW) model to one where holders can stake their ether to confirm transactions on the network. By staking ether, users will receive validator rewards and network fees. Proof of stake is an alternative consensus algorithm that rival’s Bitcoin’s proof of work.

With more and more options and avenues for users to participate financially in the consensus and governance of blockchains, the growth of staking will likely lower the barriers to entry to the crypto ecosystem. Binance is eager to support blockchains powered by Proof of Stake and will allow users to stake and earn rewards directly onBinance.com. Typically, users that stake larger amounts of coins have a higher chance of being chosen as the next block validator. While ASICs mining requires a significant investment in hardware, staking requires a direct investment (and commitment) in the cryptocurrency. UnlikeProof of Work (PoW) blockchains that rely onmining to verify and validate newblocks, PoS chains produce and validate new blocks through staking.

- Proof of stake (PoS) is a type of consensus algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus.

- In contrast, the algorithm of proof-of-work-based cryptocurrencies such as bitcoin uses mining; that is, the solving of computationally intensive puzzles to validate transactions and create new blocks.

How to Choose a Cryptocurrency Mining Pool

The nodes are the administrative body of the blockchain and verify the legitimacy of the transactions in each block. To carry out the verification step, the nodes or miners would need to solve a computational puzzle, known as the proof of work problem.

What is proof of stake vs proof of work?

While Proof of Work rewards its miner for solving complex equations, in Proof of Stake, the individual that creates the next block is based on how much they have ‘staked’. To make things simple for you, the stake is based on the number of coins the person has for the particular blockchain they are attempting to mine.

The first miner to decrypt each block transaction problem gets rewarded with coin. Once a block of transactions has been verified, it is added to the blockchain, a public transparent ledger. Proof of Stake (POS) was created as an alternative to Proof of Work (POW), which is the original consensus algorithm in Blockchain technology, used to confirm transactions and add new blocks to the chain. Ethereum is moving away from mining and toward staking, where users will stake ether (ETH) in a deposit address to secure the blockchain.

In 2015, it was estimated that one Bitcoin transaction required the amount of electricity needed to power up 1.57 American households per day. To foot the electricity bill, miners would usually sell their awarded coins for fiat money, which would lead to a downward movement in the price of the cryptocurrency.

What’s the Difference Between Bitcoin and Ripple?

It was initially based on ahybrid PoW/PoS mechanism but gradually phased out its emphasis onProof of Work (PoW). This allowed users to mine and support the project in the early stages, without becoming fully reliant on a PoS system. Other PoS Coins have a blockchain, Nano has a so called Block Latice. In Nanos lattice there is no limit, all transaction can directly processed. Proof of Stake (PoS) was first introduced in a paper by Sunny King and Scott Nadal in 2012 and intended to solve the problem of Bitcoin mining’s high energy consumption.

Understanding Proof of Stake (PoS)

For example, someone who has deposited 64 ETH will have double the voting weight of someone who deposited the minimum staking amount. To become a block validator in the first phase of Serenity, users will need a minimum stake of 32 ether (ETH) – deposited into a special smart contract based on the former Ethereum blockchain (1.0). As mentioned, staking is the process of holding funds to receive rewards, while contributing to the operations of a blockchain. As such, staking is widely used on networks that adopt theProof of Stake (PoS) consensus mechanism or one of its variants.

Proof of stake (PoS) is a type of consensus algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus. In contrast, the algorithm of proof-of-work-based cryptocurrencies such as bitcoin uses mining; that is, the solving of computationally intensive puzzles to validate transactions and create new blocks. Although it is hard to pin an exact date on the transition, Ethereum will soon be moving to a proof-of-stake (PoS) consensus model.

How does proof of stake work?

Proof of Stake (PoS) concept states that a person can mine or validate block transactions according to how many coins he or she holds. This means that the more Bitcoin or altcoin owned by a miner, the more mining power he or she has.

For instance, a miner who owns 3% of the Bitcoin available can theoretically mine only 3% of the blocks. Proof of Stake (PoS) concept states that a person can mine or validate block transactions according to how many coins he or she holds. This means that the more Bitcoin or altcoin owned by a miner, the more mining power he or she has. Nevertheless, the scalability issues that Proof of Work has caused Bitcoin is also a problem for Ethereum. The maximum amount of transactions that the Ethereum blockchain can process is 15, which again, is substantially lower than the network needs.