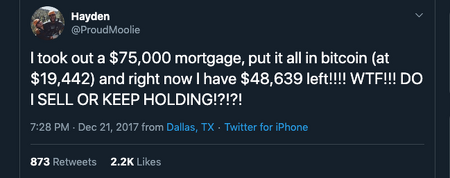

However, this type of trading technique comes with many risks that can leave traders high and dry. One risk that’s tethered to this kind of exchange is leaving funds on a trading platform that could cease operations in a blink of an eye. Lastly, bitcoin prices don’t follow most people’s predictions, and you may miss the highs and lows and lose significant amounts of funds forecasting the wrong market events. If you’ve been into cryptocurrencies long enough, you’d know that the price of bitcoin changes very often. There are plenty of bitcoiners who buy the dips and sell the tops, but those plays can have potential risks that people just holding their assets don’t have to face.

A paper in the Fall 2006 issue of The Journal of Wealth Management, by John Paglia and Xiaoyang Jiang, argues that you can market-time your dollar-cost averaging contributions. The authors suggest that the date of the month on which investors contribute money can affect their longer-term portfolio return outcome. Averaging down is an investment strategy that involves buying more shares of a stock when its price declines. Investors who use a dollar-cost averaging strategy will generally lower their cost basis in an investment over time. The lower cost basis will lead to less of a loss on investments that decline in price and generate greater gain on investments which increase in price.

Although it’s one of the more basic techniques, dollar-cost averaging is still one of the best strategies for beginning investors looking to trade ETFs. Additionally, many dividend reinvestment plans allow investors to dollar-cost average by making contributions regularly. Dollar cost averaging is often touted as a good solution to the dilemma that if you buy now you might be buying everything “at a high”.

Rather than investing small amounts of money frequently, ETF investors can significantly reduce their investment costs if they invest larger amounts less frequently or invest through brokerages that offer commission-free trading. Exchange traded funds (ETFs), which are known for their smaller expense ratios, might seem like perfect vehicles for dollar-cost averaging, but initial appearances can be deceiving. In fact, transaction costs can quickly add up when you use an ETF as part of a dollar-cost averaging investment strategy and those added costs can overshadow the benefits of DCA. The ‘Hodler’s approach’ is far less stressful than those who day trade or play intra-range strategies. Those who purchase bitcoin or other cryptocurrencies using the DCA technique don’t have to watch the charts all the time or set price alarms so they can catch rises and dips.

How does dollar cost averaging work?

Bitcoin dollar cost averaging consists in investing a fixed amount of USD, into BTC, on regular time intervals. You’ll often see it referenced by its abbreviation of “DCA”. Purchasing $10 every week, for example, would be dollar cost averaging.

Dollar-Cost Averaging: The Hodler’s Choice

Taking the maximum 401k contribution limit of $19,000 and investing $730 every two weeks into whatever index fund you like is the most common way to dollar cost average. As you can see, only when you invest more—in bigger lump sums—does the impact of the trading costs from commissions go down. The goal of dollar-cost averaging, however, is to invest smaller amounts regularly and more frequently instead of larger amounts once in a while. Clearly, in ETF investing, unless the amounts you invest regularly are fairly large, brokerage commissions can overshadow the benefits gained from dollar-cost averaging.

It’s at these times you can make some good money flipping bitcoins. For instance, if you purchase BTC at a low entry point and the price gains by 20 percent and you sell the BTC at that high then there’s potential to gain more bitcoins, if it drops back down to any number below the top sale. You can do it just a few times a month, or you can make a career out of trading cryptocurrencies.

I have been actively trading in and out ETFS and GLD with my IRA during this recent Covid-19 recession. I’m not sure if it has been genius (vs no active management) or if I have become a victim of my own doing. I aim to get that lump sum in soon that I took out as the market was declining. In the last two weeks I have managed my trades/investments without a clear predetermined strategy.

- It is important to note that this example of the dollar-cost averaging strategy works out favorably because the hypothetical results of the S&P 500 Index fund ultimately rose over the period of time in question.

If price goes down afterwards you are happy that you can now buy more of something you wanted anyway but now at a lower price. Either way you are happy, or at the very least have a way to rationalise that you did the right thing. Dollar-cost averaging isn’t for everyone, and some people believe buying dips and selling at tops is a far more profitable means of investing. However, most people would agree that DCA is a safer method of investing because it’s less stressful and you don’t have to keep money on an exchange or pay lots of fees to send money to trading platforms. Many people know that if you have bitcoins, you can sell them when you think the market has reached resistance or a high that will be followed by a significant dip.

Cash equivalents include certificates of deposit, Treasury bills, money market funds and similar investments. They typically earn lower returns than stock or bond investments but present very little risk to your principal. Cash equivalents may help you cushion your losses in the event of a downturn in the stock or bond markets. Keep in mind that money market funds, while considered safe and conservative, are not insured by the Federal Deposit Insurance Corporation the way certificates of deposit may be.

For example, if the expense ratio is nine basis points, the cost of the expense ratio is nine cents on a $100 investment and 90 cents on a $1,000 investment. The expense ratio is fixed and so it doesn’t matter if the investment is large or small because the percentage remains the same.

It is important to note that this example of the dollar-cost averaging strategy works out favorably because the hypothetical results of the S&P 500 Index fund ultimately rose over the period of time in question. Dollar-cost averaging does improve the performance of an investment over time, but only if the investment increases in price. The strategy cannot protect the investor against the risk of declining market prices. The purchases occur regardless of the asset’s price and at regular intervals; in effect, this strategy removes much of the detailed work of attempting to time the market in order to make purchases of equities at the best prices.

Day Trading Bitcoin and Intra-Range Strategies Can Be Risky

I have concluded that I prefer a disciplined predetermined strategy. DCA is a start, but I think there has to be a ratio that is optimal. The purpose of dollar cost averaging is to make investing easy for the average person who is not all caught up in the stock market.

Dollar-cost averaging is also known as the constant dollar plan. ETFs can be excellent vehicles for dollar-cost averaging—as long as the dollar-cost averaging is appropriately done.

Using the DCA method means purchasing a fixed dollar amount of bitcoins no matter what the price happens to be. Further, the DCA technique requires purchasing the fixed dollar price using a scheduled calendar as well. While dollar-cost averaging with ETFs isn’t a strategy that will work well for everyone, that doesn’t mean it isn’t worthwhile. Like all investment strategies, investors need to understand what they are buying and the cost of the investment before they hand over their money. Dollar-cost averaging is a tried-and-true investment strategy that allows investors to participate in the financial markets in a cost-effective way without the need to make large, lump-sum investments.

In this scenario dollar costs averaging allows you to buy some now and then some later at the new lower price getting you in at a better average price. If the price doesn’t dip then you buy some now and some later at the higher price. Your average price is higher but you are still happy because the price is up and you have made money. Maybe dollar cost averaging is all about pain and regret minimisation rather than return maximisation. If price goes up afterwards you are happy that you at least got in early with a partial puchase before the price rise.

What is Dollar-Cost Averaging (DCA)?

Now, these types of investors are purchasing small amounts of bitcoin and using a strategy called dollar cost averaging. Determining the expense ratio is the easy part when computing the costs of a dollar-cost averaging approach with ETFs. Since the ratio is a fixed percentage of the investment, it has the same impact regardless of the amount of money invested.

DCA for Other Coins and Assets

DCA investors are investing in the digital asset for the long haul, and everyday price volatility is meaningless to the hodler to a degree. Another aspect of buying a fixed dollar amount using a schedule means the investor doesn’t have to transfer funds to an exchange or keep funds there for faster trades. DCA investors can hoard their savings using cold storage and only send when they are ready to sell. Investors that are hedging bitcoin like hoarders or ‘hodlers’ for much longer term gains use a strategy called ‘Dollar-Cost Averaging’ (DCA). This technique is used by those who believe in the long-term progress of bitcoin and other digital assets.

The general idea of the strategy assumes that prices will, eventually, always rise. For less-informed investors, the strategy is far less risky on index funds than on individual stocks. Dollar-cost averaging can also be used outside of 401(k) plans, such as mutual or index fund accounts.