This is why many day traders lose all their money and may end up in debt as well. Day traders should understand how margin works, how much time they’ll have to meet a margin call, and the potential for getting in over their heads. Getting started in day trading is not like dabbling in investing. Any would-be investor with a few hundred dollars can buy shares of a company and keep it for months or years. However, under FINRA rules,pattern day tradersin the equities market must maintain a minimum of $25,000 in their accounts and will be denied access to the markets if the balance drops below that level.

Cryptocurrency exchanges are simply online platforms that allow you to make accounts, and login to buy, sell, and trade cryptocurrencies. But, the price of a currency in one exchange might be different to that in another, and the prices of all the currencies are also always changing. There are people in this world who would sell a blind person a pair of glasses if they could make money. Those same people play in the cryptocurrency markets and use every opportunity to exploit less-informed investors.

Staking cryptocurrencies

You could then take 3 day trades in any 5 business day period, in each account, and never get flagged. Even having $15,000 and spreading it across 3 accounts would mean $5,000 in each and still only 9 day trades in any 5 day period. Not only is it a logistical nightmare to manage three different day trading accounts, but the capital is also small in each. Instead of taking bigger trades with more capital, this day trader will end up taking more trades with smaller chunks of capital.

Is crypto trading still profitable?

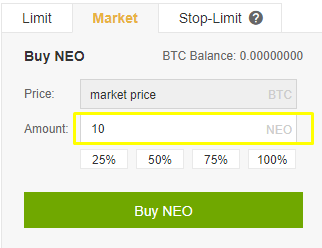

You don’t have to worry about day trading limits on cryptocurrencies because they’re not regulated by FINRA or the SEC like stocks and options. The market data displayed in this demo is not real time. Sell: You’ll never receive less than the amount you enter to sell your specified amount of a cryptocurrency.

Trading volume

If you live outside the US, check the regulations in your country, or a neighboring one. While these markets may not be as big, you can typically find a least a handful of good day trading candidates. So even if you can only find a few stocks with good movement and volume on that particular exchange, that may be enough. Oddly enough,Bill Lipschutz made profits of hundreds of millions of dollars at the FX department of Salomon Brothers in the 1980s – despite no previous experience of the currency markets. Often called the Sultan of Currencies, Mr Lipschutz describes FX as a very psychological market.

Beginners should also learn Bitcoin trading strategies and understand market signals. Bitfinex – Bitfinex is the world’s #1 Bitcoin exchange in terms of USD trading volume, with about 25,000 BTC traded per day. Customers can trade with no verification if cryptocurrency is used as the deposit method.

What should I look for when trading Cryptocurrency?

Top Crypto Exchange Binance’s CFO: Business Still Profitable, Despite Bear Market. The chief financial officer of crypto exchange Binance — currently the world’s largest by daily traded volume — has said business remains profitable, despite the market downturn.

Day traders enter and exit trading positions within the day (hence, the term day traders) and rarely hold positions overnight. Day traders can also use leverage to amplify returns, which can also amplify losses. The question is impossible to answer because few day traders disclose their actual trading results to anyone but the Internal Revenue Service. Results, moreover, vary widely given the myriad of different trading strategies, risk management practices, and amounts of capital available for day trading.

Nine Rules of Crypto Trading

Information coming from even the best investor is, at best, great information, but never a promise, so you can still get burned. If you have less than $25K, your next best options are to day trade forex or futures. These markets require less capital and are also great day trading markets. One of the big problems for most new traders is that they overtrade.

Many traders watch the markets constantly, and if that doesn’t sound like fun to you then day trading might not be the way to go. When you day trade you’re trying to take advantage of cryptocurrency price fluctuations that typically happen within a day. Though, you can also do swing trades which will happen over a series of a few days or even a couple of weeks. Often times these are smaller gains, but they can quickly add up if you have a lot of coins.

Business Model Innovation And The Future Of Crypto

- The rule only applies to stocks and options, not forex and futures markets which are also viable for day trading.

For strategies like day trading, you need to be looking at charts and your computer constantly, manually buying and selling when you think the time is right. This involves a lot of work using your own brain to come up with predictions based on the data…not to mention staring at complex financial charts for hours on end. When you’re still figuring out how to make money trading cryptocurrency, this can definitely be exhausting and tedious.

Traders working at an institution have the benefit of not risking their own money and are also typically far better capitalized, with access to advantageous information and tools. Meanwhile, some independent trading firms allow day traders to access their platforms and software but require that traders risk their own capital. Most day traders must be prepared to risk their own capital to make profits. Brokerage commissions and taxes on short-term capital gains can also add up.

Remember that as with any type of trading, your capital is at risk. New traders should start trading with small amounts or trade on paper to practice.

Trading smaller amounts in different accounts is more likely to be eroded by commissions…as well as eroding the mental state of the trade. Each stock market around the globe has its own regulations. While the US stock market is the biggest, it is not the only option. You may find another stock market may be more suited to your financial condition, especially if you don’t live in the US.

They’ll tell you what to buy or claim certain coins will moon, just to increase the prices so they can exit. Due to the highly speculative nature of the cryptocurrency markets today, a good investor will always do his or her own research in order to take full responsibility for the potential investment outcome.

When you day trade you are just sitting there and the price is constantly moving. Another, not recommended, loophole is to open multiple day trading accounts.

It takes the Transaction day + 2 business days for the funds to settle. You can’t use funds you don’t officially have (still in settlement), which means that your cash won’t always be available for day trading. Using funds that aren’t settled to make other trades is called freeriding and is a violation of Regulation T.

Of course, the example is theoretical, and several factors can reduce profits from day trading. The reward-to-risk ratio of 1.5 is used because the number is fairly conservative and reflective of the opportunities that occur all day, every day in the stock market. The starting capital of $30,000 is also just an approximate balance to start day trading stocks; you will need more if you wish to trade higher-priced stocks. An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund.

And like our other successful Forex traders, the Sultan believes market perceptions help determine price action as much as pure fundamentals. The former Olympic Games’ rowers famously sued Mark Zuckerberg, claiming he stole their HavardConnection (now ConnectU) idea when creating Facebook. The $65m they secured in the lawsuit helped fund their subsequent venture capital projects, including bitcoin. A few years ago, it was claimed the brothers owned around 1 per cent of all the world’s bitcoins, which would put their crypto-wealth today at more than $1bn. In 2015, the pair launched a cryptocurrency exchange, Gemini.

The rule only applies to stocks and options, not forex and futures markets which are also viable for day trading. There is no minimum legal requirement for day trading forex, although starting with at least $500 is recommended, and ideally $5,000 or more if hoping to make any sort of income. If you are interested in forex, my Forex Strategies Guide For Day and Swing Traders will walk you through everything you need. Another setback with day trading a cash account is that trades take time to settle, which can be an issue with a small account. We are buying or selling something, and that cash needs to change hands.

Borrowing money to trade in stocks is always a risky business. Day trading strategies demand using the leverage of borrowed money to make profits.

Currency and exchange arbitrage

They also have holdings in other cryptocurrencies, including ether. This strategy is not for everybody, and you’ll need to evaluate whether you’re prepared to keep up with it.

Aspiring day traders need to factor all costs into their trading activities to determine if profitability is attainable. Cryptocurrency gains have caught the imagination of masses after 2014. The Bull run of 2017 is still very much fresh in people’s mind.