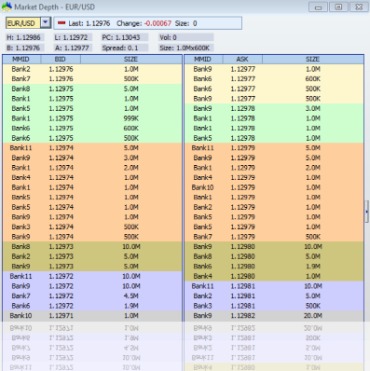

Traditional technical analysis, which involves trading based on price action or indicators that involve transformations of price and/or volume, relies on Level I data. One more reason why you need to analyze market depth is the buy and sell walls. If there are too few pending orders, one person with a huge amount of money can open a big order, creating an attractive price for other people, but they cancel these orders the moment before opening at a good price. This is a chart of the market makers — the people putting up offers to buy or sell.

- The very far left and right columns represent different market makers.

- In normal security or commodity trading, the order book — the set of all the buy and sell orders — has a fair bit of depth.

- Whether you want to start trading now or practise your strategies first on our trading charts, there is an account to suit you.

Instead, they are based on lines drawn directly between the closing prices. This chart type is commonly used in reports and presentations to show general price fluctuations; however, they often lack granular information. When compared to other trading chart types, they are not as precise in identifying trading patterns or entry or exit points. Whether you want to start trading now or practise your strategies first on our trading charts, there is an account to suit you. You can also browse our instruments page for live market data for financial assets including stocks, forex and commodities. One of the most important things in cryptocurrency trading is understanding the demand and supply of a specific asset. The depth chart is a great method to understand how many buy and sell orders are carried out.

It may be free or it may not be available on some brokerages altogether. Level II data is generally more expensive than Level I data on stock and futures trading platforms. A depth chart is split in the middle, which is the price of the asset during the last trade. When there is a set supply and varied demand the value of any particular asset will fluctuate. These fluctuations are reflected in the overall mid market price, which averages out both sides of the graph.

Reading A Depth Chart

Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. A depth chart is a visual representation of buy and sell orders for a particular asset at varied prices.

Get tight spreads, no hidden fees, access to 11,000 instruments and more. The interval of the new linked chart stays the same, so you can view multiple chart time frames quickly and easily. All technicals, drawing tools and settings from the current group will be applied to the newly linked chart.

Margin Trading

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website. For most traders, Level I data will be available to you through your broker. The display of the market-depth data can include features such as charts of tick-prices and buy/sell volumes. Notice the large number of green bids/buys on the left side of the image at $671/BCH. The overlap between $5,996 and $5,983 is possible because of SFOX’s aggregated orderbook from many global exchanges and liquidity providers and is an arbitrage opportunity to SFOX traders.

A lot of people say that any cryptocurrency isn’t reliable for investments. However, this statement is false because you need to have some qualifications. You are not supposed to trade cryptocurrencies if you don’t know how to trade less volatile assets, such as stocks.

As I write this the Kraken graph looks closer to the one you posted for GDAX, except the Buy/Left has a spread of about 0.4$, and the Sell/Right, which is roughly twice as large, has a spread of $0.11. I believe you mean “you’ll receive $112,935″…unless the exchange is so scammy that they actually charge you 1BTC to sell 1BTC. I’ve also been tweaking the post as I get readers asking “hold on, I didn’t understand that bit.” No meaning changes, just clarification . No writer can know everything about an area, but they do owe it to their readers to do their best and get a knowledgeable eye to look it over if possible. It’s not frequently prosecuted, because doing so involves proving intent.

This kind of chart illustrates both sides of supply and demand to show exactly how much of an asset you can sell at a particular price point. By registering for an account with us, you can set-up live trading charts and gain access to all of our platform features that are exclusive to account holders. This includes daily Reuters and Morningstar updates, as well as chart forums and module linking opportunities. It is possible to use our drawing tools to highlight trendlines, chart patterns and support and resistance levels for each asset that you are trading.

If more transactions are filling closer to the ask , that may indicate that the price may be inclined to go up. In this particular example, there are more shares being offered on the ask side (left-hand side), denoting that buyers are, in effect, more powerful than sellers. Accordingly, this might inform a trader of a bullish bias insofar as the Level II data / order book wager into the decision-making process. The very far left and right columns represent different market makers.

When there is data plotted in a specific direction, traders can identify an overall direction that the asset’s price is moving towards. However, some trends can be difficult to spot, which is why traders often use multiple chart types to carry out closer analysis. A depth chart is a graphical representation of buy and sell orders for a specific asset at various prices. A depth chart illustrates both sides of supply and demand to show how much of an asset you can sell at a particular price point. A liquid asset will have a depth graph where both green and red sides nearly mirror one another, reflecting almost perfect amounts of supply and demand on their respective sides. An illiquid asset will display a depth chart where supply and demand are not represented equally such as the one below.

Each costs $1 and on the graph along the x-axis, we will see an order with this data. The order to buy the 10 apples will be demonstrated on the y-axis. On the left side, we see the buy orders and on the right, we see the sell orders. Usually, the first are displayed via green lines on the diagram, and the second are displayed via red lines. If you cancel small pending orders, this is a normal situation.

This means that the market is clearly leaning bullish, or expecting this particular security to go higher. They are securities or assets dealers who provide liquidity to the market by being willing to buy and sell at specific prices at all times. Also, we can’t say that cryptocurrency trading isn’t profitable and stable at all. There are a lot of stable coins that are connected with fiat money and keep all the advantages that classic cryptocurrencies have.

Trade Directly From Charts With Cmc Markets

The very top of the chart show the bid (160.950) and ask (160.960) prices, or standard Level I data. Skilling are an exciting new brand, regulated in Europe and beyond, with a bespoke browser based platform, allowing seamless low cost trading across devices. In all instances, we collect the market-depth data from you centrally, and the traders’ app connects to us – e.g. the add-on to their copy of the Trade Terminal connects to our servers to display the market-depth. You do not need to worry about thousands of individual connections to your price server; there is only one central connection, from us.

On the left there’s a pile of people who want to buy BTC from you, at what price they’ll pay. On the right are a pile who want to sell BTC to you, at what price they’ll accept. Many forex brokers offer Level II market data, but some do not. Many will give you only Level I data and a charting platform. Level II would include a list of bid and ask prices up and down the ladder.

This is a visual diagram that illustrates the supply and demand. In this article, we will discuss the most popular chart types on our online trading platform, Next Generation, along with examples of overlays, technical studies and drawing tools that you can apply to price charts. This may help you to find the trading chart for your trading personality and style, in order to make more informed investment decisions. We have put together a video below on the different chart types that exist on our platform for an in-depth exploration. Bar charts are very similar to candlestick charts in appearance, and also show opening and closing prices, as well as the highs and lows for a specific period.

In crypto, margin traders have a habit of borrowing a lot on margin. The green line is cumulative “buy” orders below the current price — if you have coins to sell, they will buy them from you. The red line is cumulative “sell” orders above that price — if you want to buy coins, they will sell them to you. This raises the “price” on Bitfinex and lowers it on the other exchange. Tether, Inc. — which was set up by the people from the large crypto exchange Bitfinex, and remains closely associated — issue these as tokens running over other blockchains. They state that every USDT is backed by a US dollar on deposit. So far, the market has treated USDT as if they are indeed pegged to USD.

Binance Depth Chart Tutorial

Each new brick appears once the price has moved a particular amount, and they stay the same colour until a new reversal occurs. When trading with Renko charts, traders may wish to ride the trend as long as the colour stays the same. If it starts to reverse, traders could then consider exiting their positions, as it may signal a price reversal. Trading charts are an important aspect of technical analysis that allow traders to study the price action of various financial assets. This helps to analyse price movements, identify entry and exit points in a trade, and decide where to place stop-loss and take-profit orders. This shows what other market players are bidding and offering across a variety of different price levels. In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at.

Line charts are perhaps the simplest type of charts in the financial markets. There is no high or low point specified, unlike bar and candlestick charts.