As you can imagine, leveraged trading can lead to great profit but also to great losses. BitMex created a special type of leveraged trading for gamblers (eh em… traders) that have an affinity for 100x leverage. It is known as cross margin (or spread margin) leverage. A trader may commit the entire amount that they have available on deposit to ensure they do not default on their obligation whenever there are adverse price fluctuations on a 100x leveraged contract position. An account must be funded with at least $1 worth of bitcoin before it can be used to trade.

Like many of the exchanges that operate through cryptocurrencies, BitMEX is currently unregulated in any jurisdiction. The stop order in the Short position is assuming that you are more convinced that the price will go up. I really recommend to have a tendency about the price, don’t try to monetize from any position because it’s too risky, use TA or follow some good traders like EXCAVO from Trading View and follow their signs, then act accordingly. The idea about this strategy is to get the tendency of the price. Sometimes, even with TA, we think the price will go up and then it goes down, or the opposite.

You open a position to BUY/LONG BTC at the price of U$6700 with a leverage of 10x in one of your BitMex accounts; then you go to your other account and open a position to SELL/SHORT BTC at the same price of U$6700 with a leverage of 10x. You send U$50 to one of your accounts in BitMex and U$50 to the other one.

The Next Generation of Bitcoin Trading Products

Auto-deleveraging means that if a position bankrupts without available liquidity, the positive side of the position deleverages, in order of profitability and leverage, the highest leveraged position first in queue. Traders are always shown where they sit in the auto-deleveraging queue, if such is needed. BitMEX is world’s No1 margin trading platform for Bitcoin. In July 2018, believe it or not, the big broker firm reached 1,000,000 Bitcoin being traded on their platform on a single day. At a price level of round about 7000 USD that’s a total US Dollar value of about 7 billion.

Then, let’s suppose the BTC price is U$6700 and after your trading analysis, you and many other traders think BTC price will go up in the next days. It has barely $300 billions in market cap and that makes it very easy to manipulate for people with big amounts of money. While BitMEX is a leader in volume when it comes to bitcoin (BTC), most other offerings maintain relatively low levels of liquidity. At times, this makes the degree of price movement when entering/exiting positions so drastic that trading some available assets may be impractical. Professional traders and experienced investors can choose to jump into trading derivatives in bitcoin through the BitMEX platform.

Have you ever stumbled upon XBT while looking for Bitcoin price online? Coinbase, a popular digital currency exchange; CoinMarketCap, a cryptocurrency research and data website displays the BTC ticker. Also many other online portals and exchanges specify Bitcoin as BTC. On the other hand; XE, a popular foreign exchange; Bloomberg, a popular financial data and media company uses XBT to symbolize Bitcoin. Not just them but even some popular cryptocurrency trading websites like Kraken and BitMEX are using the term XBT to denote Bitcoin.

A BitMex long hedge can lock in a favorable fluctuation in the price of bitcoin for those looking to accumulate the cryptocurrency over time. Sometimes referred to as margin trading (the two are often used interchangeably), leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Unlike many other trading exchanges, BitMEX only accepts deposits through Bitcoin, which can then be used to purchase a variety of other cryptocurrencies. BitMEX specialises in sophisticated financial operations such as margin trading, which is trading with leverage.

There is no doubt that Bitcoin enthusiasts and cryptocurrency traders prefer BTC as a symbol of Bitcoin. But do you know that there is another symbol for Bitcoin called XBT?

However, if the market moves against you and you’re in loss, your trade will automatically be closed and your collateral liquidated when the market reaches a certain price – this is known as the liquidation price. Margin trading and choosing to engage in leveraged activity are risky processes and even more advanced traders can describe the process as a high risk and high reward “game”.

To manage the accounts, I just use different browsers, sometimes I have one on my laptop and the other on my iPad. If you set an automatic closing position when the price goes up or down, for example, 10%, you don’t have to worry about that account, the position will be closed and your money safe. The only one I track is the one I think it will go further than 10%, if after the trading analysis I believe the Bitcoin will go up, that’s the one I have to check. Use the resources mentioned in the article and try with the DEMO version of Bitmex first if you don’t feel ready.

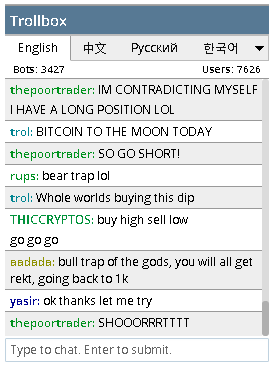

It’s more suited for those with a background in traditional finance. BitMEX claims to have high leverage on its derivatives products and strong site-wide security protocols. BitMex Markets include XBT, ADA, BCH, EOS, ETH, LTC, TRX, and XRPOn exchanges like BitMex, futures contracts are bets on the future value of very liquid cryptocurrencies.

Unverified Markets

This means that you can borrow money from the exchange in order to buy crypto. The interest rate depends on the trade but can apparently be as low as 3.65% per year (0.01% daily).

You can also short the Bitcoin price (profit from a fall in its price) by Selling the Contract. Unfortunately, I have no video, I recommend you to read the FAQ section on Bitmex, that helped me a lot when I started.

- There is no doubt that Bitcoin enthusiasts and cryptocurrency traders prefer BTC as a symbol of Bitcoin.

- Have you ever stumbled upon XBT while looking for Bitcoin price online?

Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees.

What Is BitMEX?

Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. If you’d like to turn a bear (falling) market into the opportunity to make a profit, you may want to consider leverage trading. In my case, I take a decision depending on the cryptocurrency I am trading and in the analysis I made. In BTC I would take profit with 15% to 20% (with the leverage of 10x you are having a profit of 150% to 200%). Because of the money lost in the sell/short position, anything above 10% (100% with 10x leverage) is a profit.

XBT, ADA, BCH, EOS, ETH, LTC, TRX, and XRP are very liquid cryptocurrencies. It is also the cryptocurrency that this article is really focused on. You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Cryptocurrencies markets are unregulated services which are not governed by any specific European regulatory framework (including MiFID). Trading with eToro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders.

A trader is trading with leverage whenever their contract position is larger than their margin. BitMex allows futures traders to enter long or short positions that are multiples of the amount that they have on deposit in their account. While BitMEX offers several cryptocurrencies to trade, all profits and losses are settled in bitcoin, which BitMEX refers to as XBT (instead of the more often seen BTC). As a result, users must deposit and withdraw funds in bitcoin, rather than dollars, even though dollars are what the platform’s cryptocurrencies are traded against. You can buy 1 Bitcoin ($11,670 at time of screenshot) with 0.1 BTC ($1,167) by buying a 10x leveraged position.

To be honest, I haven’t tried with forex or anything else. Usually, when trading you need to open an account and verify it, most of the companies don’t allow users to open more than one account. I know for sure that Bitmex has no restrictions about it, but I can’t talk about others. But the strategy about going long and short at the same time should work in any kind of trading in theory, I don’t see why not.

Even though cryptocurrency prices are quoted in US dollars, it is not accepted on the platform. BitMex traders must already have some bitcoin in their possession to fund the account. Those not into speculation may still find BitMex very valuable. For example, the platform could be used to execute a simple long hedge while waiting for funds to transfer from a bank account to a gateway exchange like Gemini or Coinbase.

If I am trading other coins like Cardano, Ripple or Bitcoin Cash, depending on the analysis I would take profit between 20% to 40% (with leverage 10x is 200% to 400% profit). BitMEX, short for “Bitcoin Mercantile Exchange”, is an advanced derivatives trading platform for cryptocurrencies. BitMEX serves as an interface for investors to interact with global financial markets using bitcoin.

BitMEX

But with this strategy, we can be sure that the price will start to move in one way, once we are in that tendency we can keep going until we get a profit and then close the trade with green numbers. The idea is to get two positions (BUY and SELL) opened at the same time, but you can experiment and try the best option for you.

Supported Cryptocurrencies on BitMEX

New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies before considering whether to open a live account. As a result of the amounts of leverage involved, it’s possible that the losers may not have enough margin in their positions to pay the winners.

BitMEX operates as a crypto to crypto exchange and makes use of a Bitcoin-in/Bitcoin-out structure. BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market.

Is BitMEX an exchange?

Simply put, BitMEX is an exchange that combines margin trading and derivates of crypto assets for cryptocurrency traders.