Where can you spend Bitcoin?

For any compensation of losses caused by such exchanges or purchases there is no legal entitlement. As of April 2017, cryptocurrency exchange businesses operating in Japan have been regulated by the Payment Services Act. Cryptocurrency exchange businesses have to be registered, keep records, take security measures, and take measures to protect customers. The law on cryptocurrency transactions must comply with the anti-money laundering law; and measures to protect users investors.

They allow buyers and sellers in the same areas to find each other and meet up to trade bitcoins for cash. With peer-to-peer exchanges, it’s important to remember that you are trading high-value currency with strangers you have never met before. If you choose to exchange bitcoin in this way, we recommend that you meet buyers and sellers in a public place with high visibility. The Square Cash app is a leader in peer-to-peer money transfers, right alongside PayPal’s Venmo.

The decision did not see bitcoin as currency nor bond under the current Banking Act and Financial Instruments and Exchange Law, prohibiting banks and securities companies from dealing in bitcoins. The decision also acknowledges that there are no laws to unconditionally prohibit individuals or legal entities from receiving bitcoins in exchange for goods or services. Financial institutions are not allowed to facilitate bitcoin transactions.

That’s a direct result of anti-money laundering policies. There are several things that every aspiring Bitcoin investor needs. A digital wallet, personal identification documents, a secure connection to the Internet, a method of payment, and an account at a cryptocurrency exchange are the usual requirements. Valid methods of payment using this path include bank accounts, debit cards, and credit cards.

Bitcoin: What is it, where can you use it and is it worth investing?

It is also possible to get bitcoin at specialized ATMs and via P2P exchanges. However, be aware that bitcoin ATMs were increasingly requiring government-issued IDs in early 2020.

On 5 December 2013, the People’s Bank of China prohibited Chinese financial institutions from using bitcoins. After the announcement, the value of bitcoins dropped, and Baidu no longer accepted bitcoins for certain services. Buying real-world goods with any virtual currency had been illegal in China since at least 2009. Bitcoins are created as a reward for a process known as mining.

In September 2014, Bangladesh Bank said that “anybody caught using the virtual currency could be jailed under the country’s strict anti-money laundering laws”. The National Assembly of Ecuador banned bitcoins including other decentralized digital/crypto currencies, due to the establishment of a new state-run electronic money system. Ecuador’s new project would be controlled by the government and tied directly to the local currency—the dollar. Users will be able to pay for select services and send money between individuals.

The Cash app comes from Square, the company that makes those mobile credit card readers. Square is a huge financial technology company that includes many other services—one of which is trading bitcoin. Unlike most online exchanges, the Cash App stores your bitcoin in your Square Cash Account, rather than a separate digital wallet.

The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and payment service companies from dealing in bitcoins or other digital currencies. While it warned the public of risks of bitcoins, and that they are not legal tender, bitcoins are still accepted by small businesses and merchants. The overwhelming majority of bitcoin transactions take place on a cryptocurrency exchange, rather than being used in transactions with merchants. Delays processing payments through the blockchain of about ten minutes make bitcoin use very difficult in a retail setting.

If you’re worried about security, however, you can send the bitcoin in your Square Cash Account to another wallet of your choosing. Square limits deposits to $10,000 per week, but there is no limit to what you can sell. Coinbase is the most popular and respected digital currency exchange in the United States.

Mining

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information. To heighten financial privacy, a new bitcoin address can be generated for each transaction.

Coinbase lets users securely buy and store cryptocurrency in one location. Coinbase charges a 1.49% fee for U.S. transactions from a bank account or Coinbase USD wallet. Purchases made using a credit or debit card are charged a 3.99% fee.

- In relation to individuals, the acquisition and sale of tokens is not considered entrepreneurial activity, and the tokens themselves and income from transactions with them are not subject to declaration.

- Up to 1 Jan In 2023, the Decree excludes revenue and profits from operations with tokens from the taxable base.

What is bitcoin?

At the same time NBS points out that any legal person or natural person in the Slovak Republic shall not issue any notes or any other coins. Unlawful manufacturing of banknotes and coins and putting them into circulation is punishable by law. In this context, NBS points out that virtual currencies have not a physical counterpart in the form of legal tender and participation in such a scheme (virtual currency) is at your own risk. Exchanges or purchases of virtual currencies represent the business risk of investors and investors’ money are not protected.

A cryptocurrency is a digital form of money that you can use to pay for some transactions online. Bitcoin is the most popular of the so-called “cryptocurrencies”. On 7 March 2014, the Japanese government, in response to a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions.

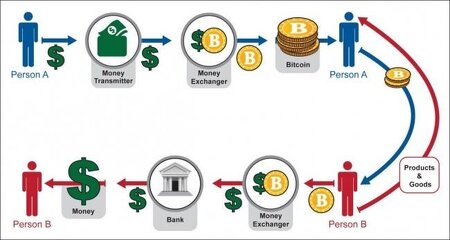

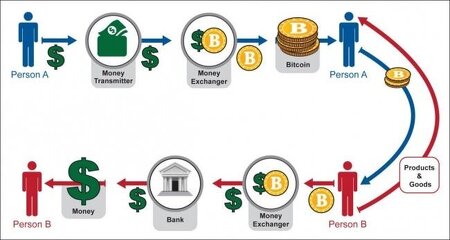

They can be exchanged for other currencies, products, and services. Research produced by University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. If you have a wallet, but it isn’t connected to a bank account, debit, or credit card, you can buy bitcoin using cash through a peer-to-peer exchange. Unlike typical bitcoin wallets, peer-to-peer exchanges work similarly to Craigslist for cryptocurrency.

What is a Bitcoin and how is it used?

Each Bitcoin is basically a computer file which is stored in a ‘digital wallet’ app on a smartphone or computer. People can send Bitcoins (or part of one) to your digital wallet, and you can send Bitcoins to other people. Every single transaction is recorded in a public list called the blockchain.

Following the FBI’s announcement that it would treat Bitcoin and other virtual currencies as “legitimate financial services,” Bitcoin’s value spiked by a similar amount. In late 2017, Bitcoin’s value doubled several times, only to halve in the first weeks of 2018 – wiping out billions in market value almost overnight.

It can be used to purchase goods from an ever-growing roster of merchants (including recognizable companies like Expedia and Overstock.com) that accept Bitcoin payments. It can be exchanged with other private users as consideration for services performed or to settle outstanding debts.

Prices are not usually quoted in units of bitcoin and many trades involve one, or sometimes two, conversions into conventional currencies. Merchants that do accept bitcoin payments may use payment service providers to perform the conversions.

Although Bitcoin is the most liquid and easily exchanged cryptocurrency, it remains susceptible to wild price swings over short periods of time. In the wake of the Mt. Gox collapse, Bitcoin’s value fell by more than 50%.

The Payment Services Act defines “cryptocurrency” as a property value. The Act also states that cryptocurrency is limited to property values that are stored electronically on electronic devices, not a legal tender.

Bitcoin is a virtual currency, or cryptocurrency, that’s controlled by a decentralized network of users and isn’t directly subject to the whims of central banking authorities or national governments. Although there are hundreds of cryptocurrencies in active use today, Bitcoin is by far the most popular and widely used – the closest cryptocurrency equivalent to traditional, state-minted currencies. Such activities are not regulated and supervised by the National Bank of Slovakia or the European Central Bank.

How does Bitcoin make money?

Bitcoin is a digital currency created in 2009 by a mysterious figure using the alias Satoshi Nakamoto. It can be used to buy or sell items from people and companies that accept bitcoin as payment, but it differs in several key ways from traditional currencies.

Up to 1 Jan In 2023, the Decree excludes revenue and profits from operations with tokens from the taxable base. In relation to individuals, the acquisition and sale of tokens is not considered entrepreneurial activity, and the tokens themselves and income from transactions with them are not subject to declaration. The peculiarity of the introduced regulation is that all operations will have to be carried out through the resident companies of the High Technology Park. Businesses that deal with bitcoin currency exchanges will be taxed based on their bitcoin sales.

It can be swapped for other currencies, both traditional and virtual, on electronic exchanges that function similar to forex exchanges. And, unfortunately, it can be used to facilitate illicit activity, such as the purchase of illegal drugs on dark web marketplaces like the infamous (and now-shuttered) Silk Road. When bitcoin is exchanged for sterling or for foreign currencies, such as euro or dollar, no VAT will be due on the value of the bitcoins themselves. However, in all instances, VAT will be due in the normal way from suppliers of any goods or services sold in exchange for bitcoin or other similar cryptocurrency. Profits and losses on cryptocurrencies are subject to capital gains tax.

“Electronic money is designed to operate and support the monetary scheme of dollarization,” economist Diego Martinez, a delegate of the President of the Republic to the Board of Regulation and Monetary and Financial Policy. Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility. For example, in 2012, Mt. Gox froze accounts of users who deposited bitcoins that were known to have just been stolen. International researchers and the FBI have claimed that they can track transactions made on the Bitcoin blockchain to user’s other online accounts, including their digital wallet.