Here are several reasons why we are among the market leaders. The credit card transactions, however, attract fees that average 3.75% that is considerably expensive. Moreover, the credit purchase can be considered as cash advances that may attract higher fees making the transaction expensive.

However, the credit card can increase the credit line if the exchange is considered as a purchase to enable you to spend more on Bitcoin exchange. Payment processors like Visa, Mastercard and American Express charge at least 2.9% per transaction. So any exchange selling bitcoins for CC payments is always going to pass this fee off to you, plus charge a bit more to make a profit.

The system will pair your location with that of sellers in the area nearby. I would suggest LocalCoinSwap or Paxful (the fees are a bit expensive here). You can buy BTC with online transfers, debit/credit cards, gift cards, and in cash deposits, which is the category that Walmart2Walmart transfers falls under. The exchange Coinbase allows users to buy cryptocurrency such as Bitcoin instantly when a credit or debit card is used. If you need bitcoins fast, then buying with a debit card is a good option.

Buying bitcoins with a credit card or debit card is confusing. Citigroup said earlier in February that it will no longer allow credit card customers to purchase bitcoin with a credit card issued by Citigroup. “We will continue to review our policy as this market evolves,” said a bank spokeswoman told The Wall Street Journal. Meanwhile, Bank of America and JPMorgan Chase said they, too, wouldn’t allow customers to purchase bitcoin with their credit cards anymore. According toThe Wall Street Journal, banks are growing more worried about the risks associated with customers using their credit cards to purchase cryptocurrency, namely bitcoin.

Quick Info: Popular Exchanges

Where can I buy Bitcoins with a credit card?

The exchange Coinbase allows users to buy cryptocurrency such as Bitcoin instantly when a credit or debit card is used. This is great for buying dips in the price. On most exchanges, if a credit or debit card is used, you will have instant delivery of your Bitcoins.

The fees could get lower if some exchange cuts a deal with a credit card processing company to get lower fees. On June 11, 2018 there were reports that Wells Fargo blocked all its customers credit cards from buying BTC.

A big concern is that bitcoin purchases will result in more card losses for the companies. Another concern is that credit card companies will have more fraud losses as a result of customers using them for bitcoin purchases. When there is fraud, it’s the card issuer and/or the merchant that takes the hit. With more exchanges selling bitcoin, there is an increased risk of fraud for the credit card companies. Capital One has been preventing customers from doing that since January, while Discover Financial banned it back in 2015.

Additionally, transparent fees make the cryptocurrency exchange a reliable partner for our customers. Ultimately, easy navigation through the website will help everyone to find everything one needs with ease. Using the platform, thus, you will learn how to buy Bitcoins without wasting time or thinking about security risks. Many services nowadays offer their users to buy Bitcoins, but they may often turn out to be a scam.

Can I use my credit card to buy Bitcoin?

Coinbase is probably the fastest and easiest way to buy bitcoins in the USA. If you need bitcoins fast, then buying with a debit card is a good option. Coinbase charges 3.99% fees for debit card purchases but you can get your coins instantly. Another payment option for US customers is using a connected bank account.

For instance, Bitcoin had slid from $20,000 in December 2017 to new lows of $8,000 as at mid-February 2018. In the USA, some banks are blocking users from buying cryptocurrency on credit.

Coinbase charges 3.99% fees for debit card purchases but you can get your coins instantly. There are two main disadvantages of buying Bitcoin with a card. For example, Coinbase charges a 1.49% fee for buying Bitcoin with your bank, but a 3.99% fee if you were to use a credit or debit card. On most exchanges, if a credit or debit card is used, you will have instant delivery of your Bitcoins. This is perfect for buying the bottom, or catching a big move right before it happens.

- You can buy BTC with online transfers, debit/credit cards, gift cards, and in cash deposits, which is the category that Walmart2Walmart transfers falls under.

- The system will pair your location with that of sellers in the area nearby.

However, this is not a huge deal as most credit cards have already been blocked by Visa and Mastercard from buying bitcoins since January/February. Wells Fargo likely took another step, although the bank said they may allow purchases of cryptocurrency again down the line. Most exchanges will not allow you to use a pre-paid debit card. To buy bitcoin with a pre-paid debit card you will have to exchange it locally using LocalBitcoins. Below, we’ve listed 5 proven exchanges for buying bitcoins with your credit card.

By now, most everyone knows that Bitcoin can be bought on exchanges, or purchased directly from other people via P2P platforms, likeLocalCoinSwap. You can also pay for them in a variety of ways – hard cash, credit or debit cards, bitcoin cards, wire transfers, or other cryptocurrencies. The biggest factors in choosing a payment method are the seller, your urgency, and your location. At the moment, the market rate for Bitcoin credit and debit card purchases is hovering around 5%. Most exchanges will charge a fee for selling, usually around 1%-2%.

Such cryptocurrency exchanges may simply take your money and then disappear. But among many services available on the web, CEX.IO is the one that can definitely be trusted.

Coinbase Pro offers good prices and low fees, but their confusing user interface may initially prove difficult to navigate. Coinmama allows customers in almost every country to buy bitcoin with a credit or debit card. They charge a 4.9%-5.9% (depends on volume) fee on each purchase. Buying Bitcoin using a credit or debit card is a much faster way of obtaining cryptocurrency. As stated above, Coinbase does not allow US customers to use credit cards to purchase Bitcoin anymore.

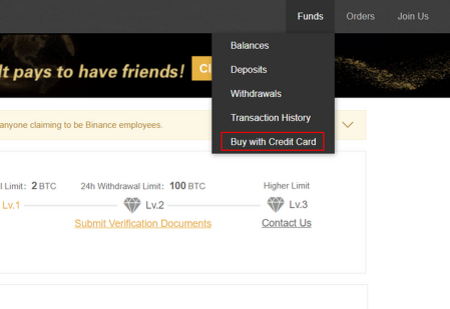

Click “Credit/Debit Card”

If an exchange claims to be the cheapest way to buy Bitcoin, could it be offering that at the cost of security? Securing a cryptocurrency exchange is expensive, and if an exchange has no income from trading fees then it’s questionable whether they have enough funds to perform decent security audits. To buy Bitcoin on CashApp, you first need to deposit some funds to the app. You can do so in just seconds by linking your credit or debit card. To buy Bitcoin cheap on Coinbase, avoid depositing funds with your credit card since an additional 3.99% fee will be charged.

Here, you will be able to easily purchase Bitcoin Cash with a credit card. Another option is to choose a Bitcoin Exchangewhere you can quickly set up an account and buy bitcoins with funds from a bank account or credit card. Keep your private key(s) private and never share with anyone. It is very important to backup your wallet’s private key and any other credentials for offline storage. Failing to backup could result in the loss of your Bitcoin holdings if you should ever lose the device on which the wallet is installed.

If available in your jurisdiction, do a SEPA transfer or ACH transfer instead since both are free. After you figured it out with the wallet, you are ready to buy and sell the crypto coins. If you want to buy your first bitcoin and don’t really feel like doing it via an exchange, you can always find someone in your area selling their bitcoins for cash or even a gift card. Coinbase’s exchange, Coinbase Pro, is one of the largest Bitcoin exchanges in the United States. Users can fund their accounts via bank transfer, SEPA, or bank wire.

Coinbase lets you buy bitcoins instantly with a credit card or debit card. Here are step-by-step instructions to help make the buying process easier for you. Now that you have a wallet, you probably want to add some bitcoin to your balance. Have your Bitcoin Cash wallet address ready and visit the buy Bitcoin page.

Coinbase’s credit and debit card purchasing fees are remarkably low compared to the competition at 3.99%. As far as limits go, they are relatively low when using a card to pay compared to other exchanges. At the beginning of 2018, Banks became weary of Bitcoin and other cryptocurrency exchange. The banks expressed their dissatisfaction with Bitcoin by banning the use of credit cards in buying the BTC and other digital assets. Coincidentally, during the time, Bitcoin and other tokens had lost over half of their value.

A quick step-by-step guide on how to buy bitcoins with debit card on Coinbase:

The exchange CEX.io will allow users to sell Bitcoin and receive funds directly to their credit card. The fees associated with this method are higher than a credit or debit card, but it certainly is possible. To learn more, check out our in-depth guide to buying Bitcoin with Paypal.

European users still appear to be able to buy crypto with a credit card. The US banks essentially felt as people were getting a cash advance since crypto is usable instantly and is basically like cash. Purchasing with a debit/credit card is one of the easiest ways to buy bitcoins. Since most people understand how to shop online using credit and debit cards, it may be easier for less technical buyers to use credit cards to purchase bitcoins.